In a word, yes. By putting actionable compliance data into the hands of frontline managers, dashboard tech translates into real workload-sharing efficiencies that help compliance do more work with fewer people while simultaneously reducing risk

The 2008 financial crisis resulted in a raft of new regulation worldwide, all aimed at reducing the risk of another finance-driven Great Recession. It also meant more stringent enforcement of existing regulation. This increased attention from regulators initially meant compliance budgets jumped dramatically, which lead to an increase in the number of compliance officers on hand. And this meant compliance could stay comfortably on top of both risk and regulation. A stasis point had been reached.

But by the end of the next decade spending on compliance leveled off. A 2019 report on the compliance function by the consulting firm McKinsey noted most banks were reporting that "compliance [spending] would remain at or near 2017 levels." But the pace of new regulation didn’t slow down. So if firms can't hire more compliance officers to keep up with an ever-increasing amount of regulation, what then? How can firms get the proper amount of compliance oversight and risk mitigation out of the same number of people?

INSIGHT DRIVEN DASHBOARDS

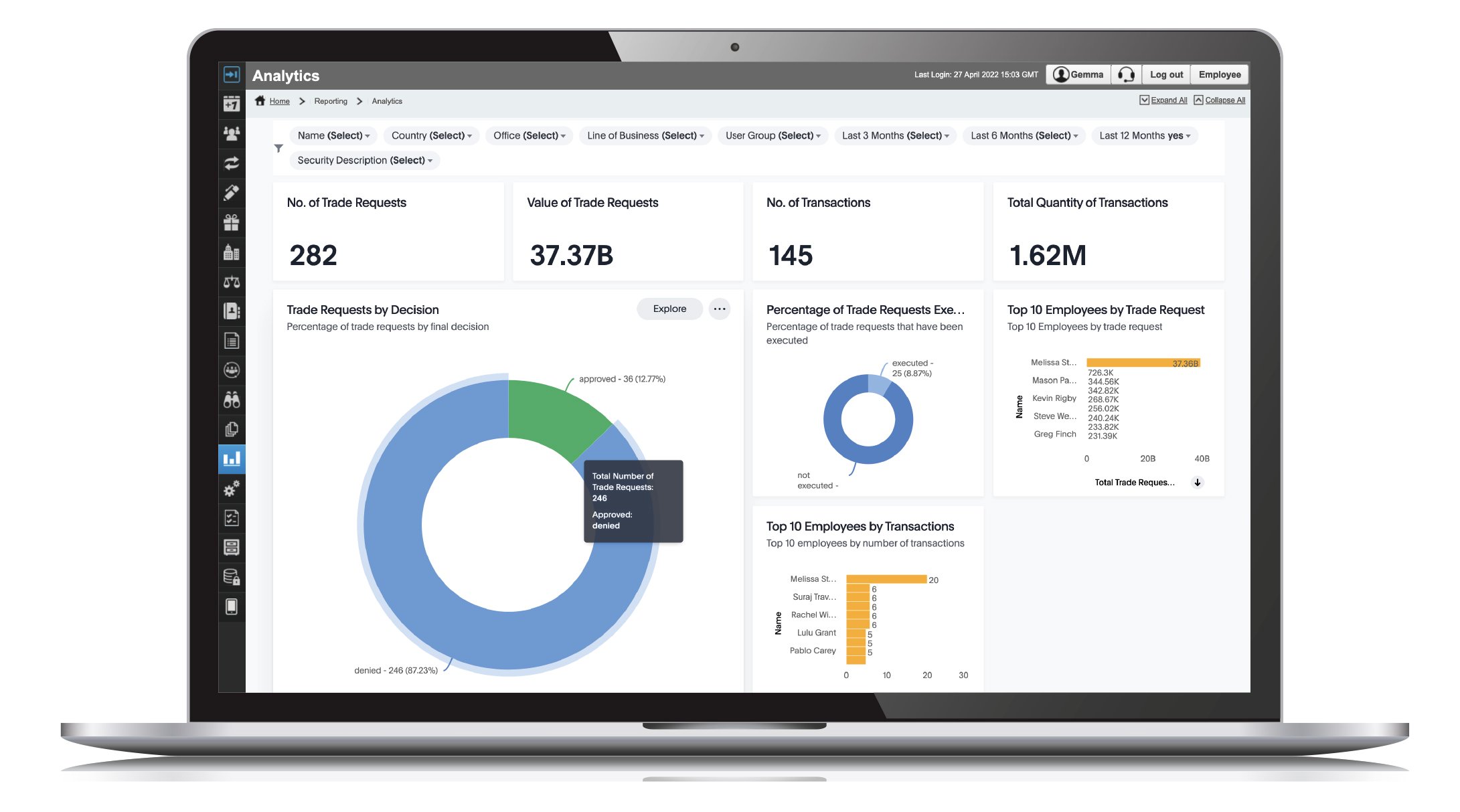

Enter dashboards. Applications that surface critical compliance data automatically, package and present it in an easily digestible format, and make it available to what's often referred to as "the first line of defense." This means supervisors. Firm management that is closest to the general employee population and who—with the help of dashboard analytics and the near-real time data they provide—can take on some of the compliance oversight work that could only previously be done by compliance officers.

This data may have always been available somewhere in the firm. The key word here is “somewhere.” Compliance data doesn’t do anyone any good if its buried in unknown or hard-to-reach locations, which then has to be purposefully dug up, sifted through, and analyzed for the kinds of trends and anomalies that allow compliance to know precisely what’s going on at the employee level. Good dashboards do this time-consuming work—automatically surfacing activity and related risk compliance might otherwise miss. The best dashboard applications—like Star’s Insight Driven Dashboards—do even more of the analysis work upfront, serving up to compliance officers and first-line managers the actionable insights tucked away inside the data and allowing them to make key decisions with increased speed and confidence.

And dashboards like Star’s do more than just create a workload-sharing efficiency. They contribute to real risk reduction. Employee managers, by virtue of hierarchical proximity, will likely be far more effective at spotting alarming patterns and unusual behaviors in their direct reports than a compliance officer ever would be, who necessarily needs to operate at a more-removed level. This effect of risk-reduction has, in and of itself, become a driver of the industry-wide trend to move compliance oversight authority down and away from a centralized compliance team. And it’s dashboards like Star’s that make this option truly viable.

The world is awash in data. 175 trillion gigabytes will be generated annually by 2025. That’s three times what was generated in 2021. Not all of this is compliance-related data, of course. But a statistic like this one does help drive home the point that, not only is there already an almost unimaginable amount of data out there circulating through the world’s software systems, more is on the way. And compliance officers are definitely feeling the effect. More employee data is piling up in more places around the firm. Manual processes for collecting and managing and monitoring it all certainly can’t cut it anymore. This is a given.

And even the automated software systems firms choose to employ to help them manage their compliance programs—part and parcel of which is all this employee compliance data—have to be a cut above the rest. Dashboards like Star’s Insight Driven Dashboards are just that. Giving compliance a holistic view of employee activity. Offering faster and easier access to actionable insights. In short, changing the way businesses interact with their compliance data. So that when it comes to risk reduction, firms can be proactive, not reactive.