The recent failures of two US banks along with the rescue of a large Swiss bank and ongoing volatility in the financial sector is a reminder that firms need reliable regulatory compliance tools to monitor firm and employee activities. As we have seen, a number of financial institutions are fighting for their survival and in these institutions, employees are struggling with the emotions of not knowing what is going to happen or whether they will have a job. These circumstances may lead to potential misconduct and misbehavior.

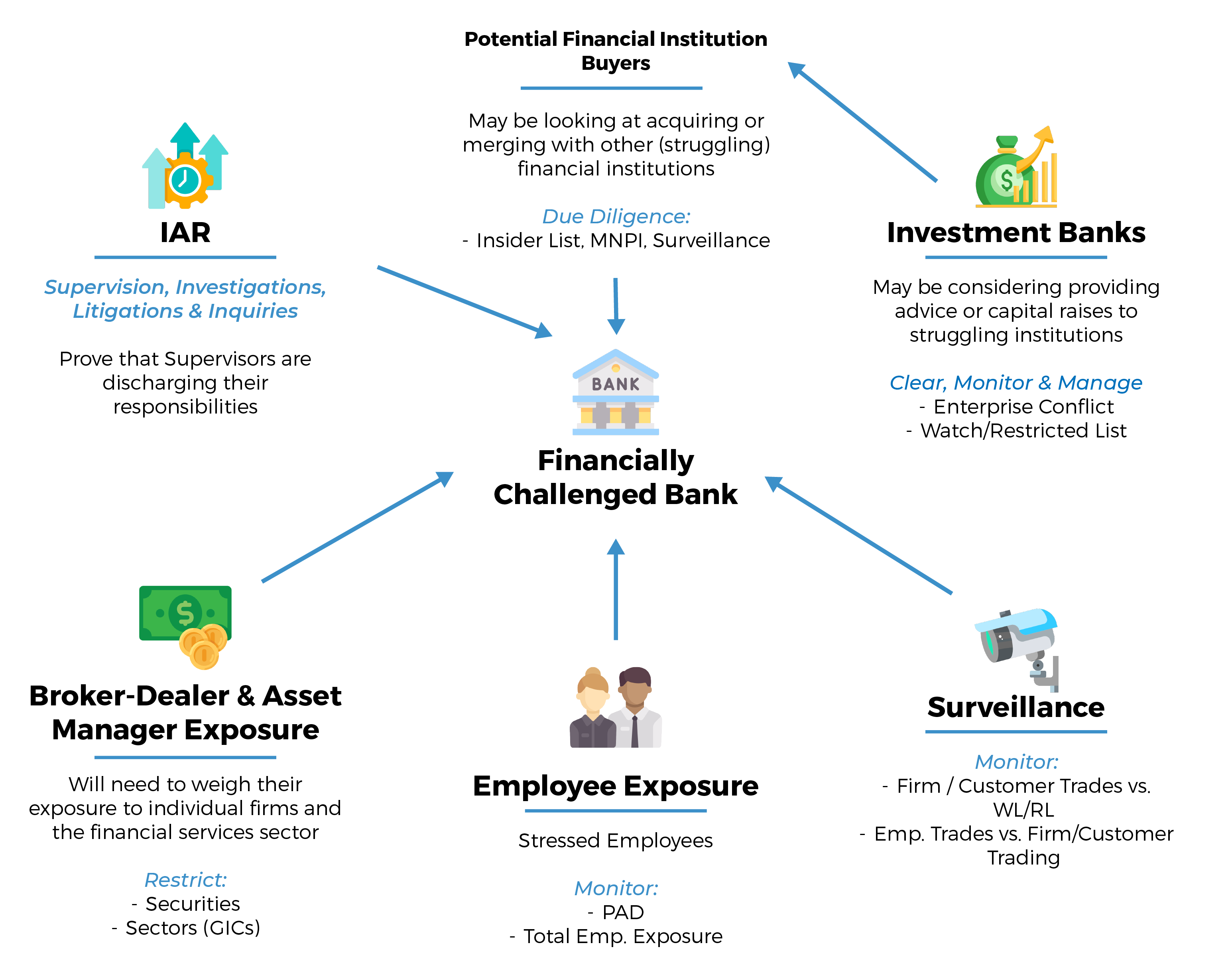

Regulators will expect firms to manage regulatory and operational risks. The image below details some of the aspects that firms should consider:

This picture displays a financial institution that is unstable and the ripple effect on employees; broker-dealers and asset managers that may have trading or holding exposure; investment banks that may be providing advice or offering capital raises; potential merger or acquisition partners; and supervisors.

TAKING ONE AT A TIME:

Employees will probably be stressed and worried about their jobs, leading to concerns about their personal wealth (e.g., company shares, bonuses, deferred comp, pensions, 401(k) plans and even 10b(5)-1 plans) which may lead to reckless behavior. Having a reliable personal account dealing tool that monitors and surveils employee activity is critical.

Broker-dealers and asset managers may have exposure to the troubled institution. Buy-Side and Sell-Side firms may restrict certain activities or increase monitoring in particular companies or sectors. Having a reliable restricted list and surveillance tool is paramount.

Investment banks may be engaged to offer advice or provide capital-raising services for struggling financial institutions. These investment banks must have proper controls to identify and clear conflicts and monitor MNPI and deal information via Watch/Restricted List.

Merger or acquisition partners may be conducting due diligence and therefore will have access to MNPI. These potential buyers also must have proper controls to identify and clear conflicts along with monitoring and surveilling MNPI and deal information via Watch/Restricted List.

Supervisors are reminded that regardless of the volatility and noise within a firm or the markets their individual accountabilities will likely be even more closely scrutinized. Having a reliable tool to assist supervisors and managers with monitoring, escalating and reporting risks is essential.

If the worst happens and an organization fails or is forced into a merger, the ability to manage, migrate and incorporate large amounts of firm and employee data to maintain consistent monitoring will be scrutinized by regulators and politicians alike. Merger integration is both an art and a science that requires a solid plan and partner to integrate the acquired company – whether the company has manual compliance tools and records or even has more advanced automated systems. By working with a SaaS partner with decades of experience in mergers and acquisitions, firms can successfully meet the challenges of any integration with the confidence and certainty that they are compliant across the board.