StarCompliance surveyed compliance leaders from across the financial services industry for its Compliance Benchmark Survey. Here’s what they had to say on planning priorities for 2022 and what’s keeping them up at night

StarCompliance surveyed compliance leaders from across the financial services industry for its inaugural Compliance Benchmark Survey—asking about their 2022 planning priorities, the challenges they're facing, and the solutions they're considering. Of those compliance leaders surveyed 47 responded, representing a broad swath of the industry—from asset management, to broker-dealers, to investment banking, to private equity, to diversified banking. Following are the key findings from the survey:

- 20 firms indicated that they anticipate significant changes to their compliance programs in 2022.

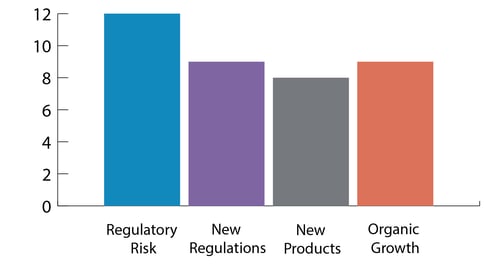

- 15 of those 20 named the following key factors as shaping their current and future-state compliance priorities:

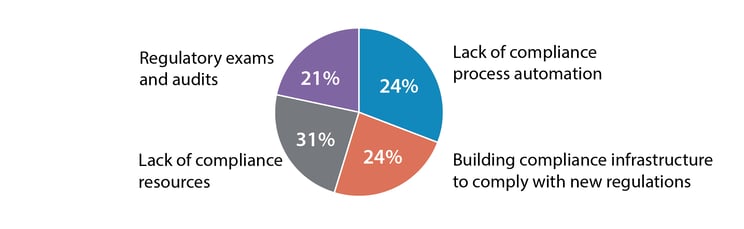

- 15 cited the following key challenges facing their compliance programs:

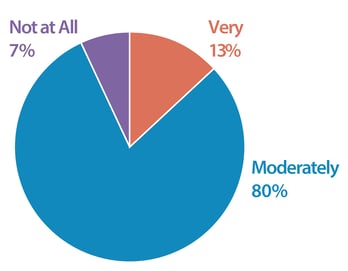

- 15 reported the following levels of concern, when asked about increased compliance officer liability for failed compliance programs:

- Finally, of respondents who didn’t anticipate major changes ahead, nearly one-third identified budget constraints, resource limitations, or both as obstacles.

THE INCREASING VALUE OF COMPLIANCE AUTOMATION

There's a lot to unpack here. Leaders are facing a variety of challenges with a lot gray area in play. Why? First, there's an uncertain regulatory landscape born out of a change in leadership at the SEC, i.e., new chair Gary Gensler, who’s at the start of a program that may mean regulatory upheaval for much of US finance. There‘s continuing economic uncertainty surrounding the ongoing pandemic. There’s a worldwide supply chain crisis, with irregular factory output and worker shortages affecting the delivery of goods and services just about everywhere. And that worker shortage is being felt as keenly in the field of compliance as anywhere else.

Uncertainty, then, is the operative word in the global economy right now, and will likely continue to be for some time. On that note, the survey showed that 93% of compliance leaders are moderately or very concerned about their personal liability. There’s a lot riding on their shoulders, after all, and in a turbocharged regulatory environment they have legitimate cause to fear they’re more of a target than ever. In the meantime, compliance officers are increasingly expected to keep firm risk at a minimum. In the face of all this uncertainty and uneasiness, one of the things compliance officers can count on is the transformative power of software: tech that lifts burdens from the shoulders of compliance teams, automates processes and workflows, and allows for clearer thinking—and hence a clearer picture—of what’s happening in their firm at every level. With all this in mind, here are three takeaways from the survey and explanations of how regtech can help compliance leaders think about and reduce risk:

1. COMPLIANCE OFFICERS MUST BE MORE IMPACTFUL

The average compliance officer spends too much time plowing through data and not enough time focusing on risk assessment: a compliance officer’s primary job. By automating non-core responsibilities, firms can give compliance teams more bandwidth to reduce operational, regulatory, and reputational risks. Considering that 93% of survey respondents expressed real concern about compliance officer liability, reducing such risks through automation can also go a long way toward quelling such fears, which will in turn go a long way toward retaining top compliance talent in a tight labor market.

2. TRANSPARENCY IS CRITICAL FOR AN EFFECTIVE PROGRAM

Automated platforms can give compliance teams the ability to connect data, identify patterns, and synthesize information into actionable insights. They can then share that knowledge with frontline managers, who are in the right position to mitigate risks or prevent them altogether. Compliance officers can also use these platforms to quickly provide a clear audit trail, which gives regulators more confidence in firm compliance programs. It’s a way to evidence compliance, in other words. Because without adequate records demonstrating compliance, regulators might be compelled to investigate further, placing a significant burden on the firm’s legal team, executives, and even lower-level employees, who will inevitably have to join compliance in managing any fallout.

3. COMPLIANCE TEAMS SHOULD BE BUSINESS PARTNERS

Compliance often finds itself in a losing tradeoff. The business side wants frictionless experiences for customers and employees, while compliance wants confidence in firm processes and policies. That no longer has to be the case, however. The right automated tools—sophisticated, integrated compliance software platforms—can create better and more obvious alignment between compliance and business objectives: clearly highlighting the business value of the office of the CCO.Our survey findings highlight the pressing need to change compliance priorities if firms want to reduce risk in a time of continuing uncertainty. Compliance process automation that enables compliance officers to focus more on critical tasks, create transparency throughout the organization, and draw a clear line between compliance and business goals will help firms protect themselves no matter what the future holds.